So the purpose of this survey, is based on an idea in behavioral finance, with the focus being on "Prospect Theory," pioneered by Daniel Kahneman and Amos Tversky.

The general idea is that we value gains and losses differently, assigning different weightings to them mentally. This supposedly influences our decisions. This is also known as 'loss-aversion.'

Many demonstrations of this offer EQUAL choices, and the participant will typically choose the one that is more loss-aversive. The poll question was deliberately skewed in the favor of the HIGHER payout, but we are still seemingly hard-wired to select the one that is most risk-adverse(LOWER PAYOUT), and offers a more certain payout.

I.e., the potential win of the $100 seems more appealing than the

expectancy of the $140 in Option B($200*70%).

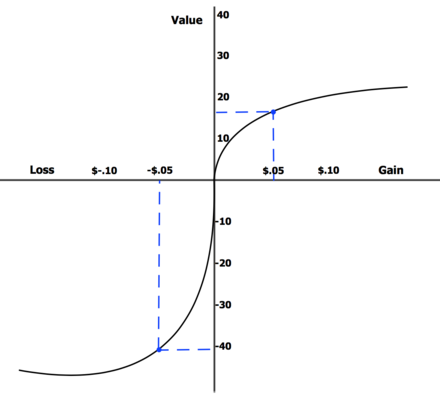

Visually, this offers a utility function attached in the image, where you can see how it is naturally skewed to be risk avoidant. You can see the value function is is steeper for our losses... I.e., we are quicker to take gains than we are to take losses.

This may explain some bad choices we make when trading, and how we may have different thoughts depending on where a position may sit, relative to where we started from. I.e., the vertical line in the graph above is our REFERENCE point.

When faced with a choice leading to gains, we are risk-averse... but we may be risk-seeking when faced with a loss. This may explain why some people may be more likely to HOLD a losing position, as as long as it is open, we have not accepted the loss yet. I do also believe this extends much further than simply how we hold/release a position, but the general way the market may function... I.e., how the collection of traders view the thing(market) as a whole.

In general, people are likely to choose options that offer lower expectancy with more certainty.

To help visualize this, here is a different example than framed in the poll.

SCENARIO 1:

Option A: 50% chance of WINNING $1000, and 50% chance of WINNING $0.

Option B: 100% chance of WINNING $500.

SCENARIO 2:

Option A: 50% chance of LOSING $1000 and a 50% chance of LOSING $0

Option B: 100% chance of LOSING $500.

Prospect theory suggest that MOST people will choose Option B from scenario 1, and Option A from scenario 2. We select the most sure thing when faced with the potential WIN, but try hard to avoid the loss in Scenario 2, hoping to be able to walk away with LOSING $0.

In short, we don't like losing.

THis is likely a ham-fisted explanation. So there are better explanations below:

Wiki

Investopedia

YT Vid I got the SCENARIOs listed above from

Another

YT Vid