Drawdown is most commonly used to refer to the high-to-low decline experienced by a trader or fund over a specified time period.

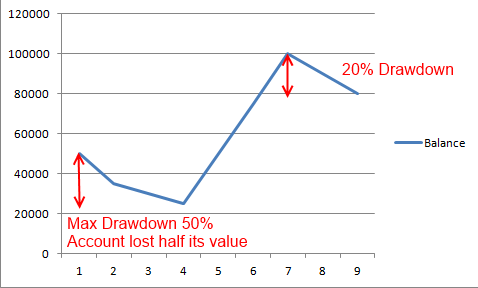

In general drawdown is quoted as a percentage, for example if $100,000 was a trader's account high point but after a series of bad trades this dropped to $80,000 this would constitute a drawdown of 20%. Drawdown is measured from the time a retrenchment begins until a new high is reached, which is why you will often hear people referring to the max historic drawdown. Maximum drawdown is the amount of equity lost by a trader or fund during its entire history. For instance a trader may have recently experienced a 20% drawdown, but in the past he could have experienced much more significant drawdown. The biggest historic drawdown is referred to as the maximum drawdown.

Source (with edits):

https://thefxview.com/2013/09/30/drawdown-explained/

See also:

https://www.investopedia.com/terms/d/drawdown.asp

https://www.babypips.com/school/undergraduate/senior-year/risk-management/drawdown-and-maximum-drawdown.html