|

Cincinnati Ohio

Legendary Master Data Manipulator

Experience: Intermediate

Platform: TastyWorks / NT

Broker: TastyWorks /NT

Trading: FX, Stocks, Options

Posts: 2,107 since Feb 2011

Thanks Given: 6,422

Thanks Received: 5,238

|

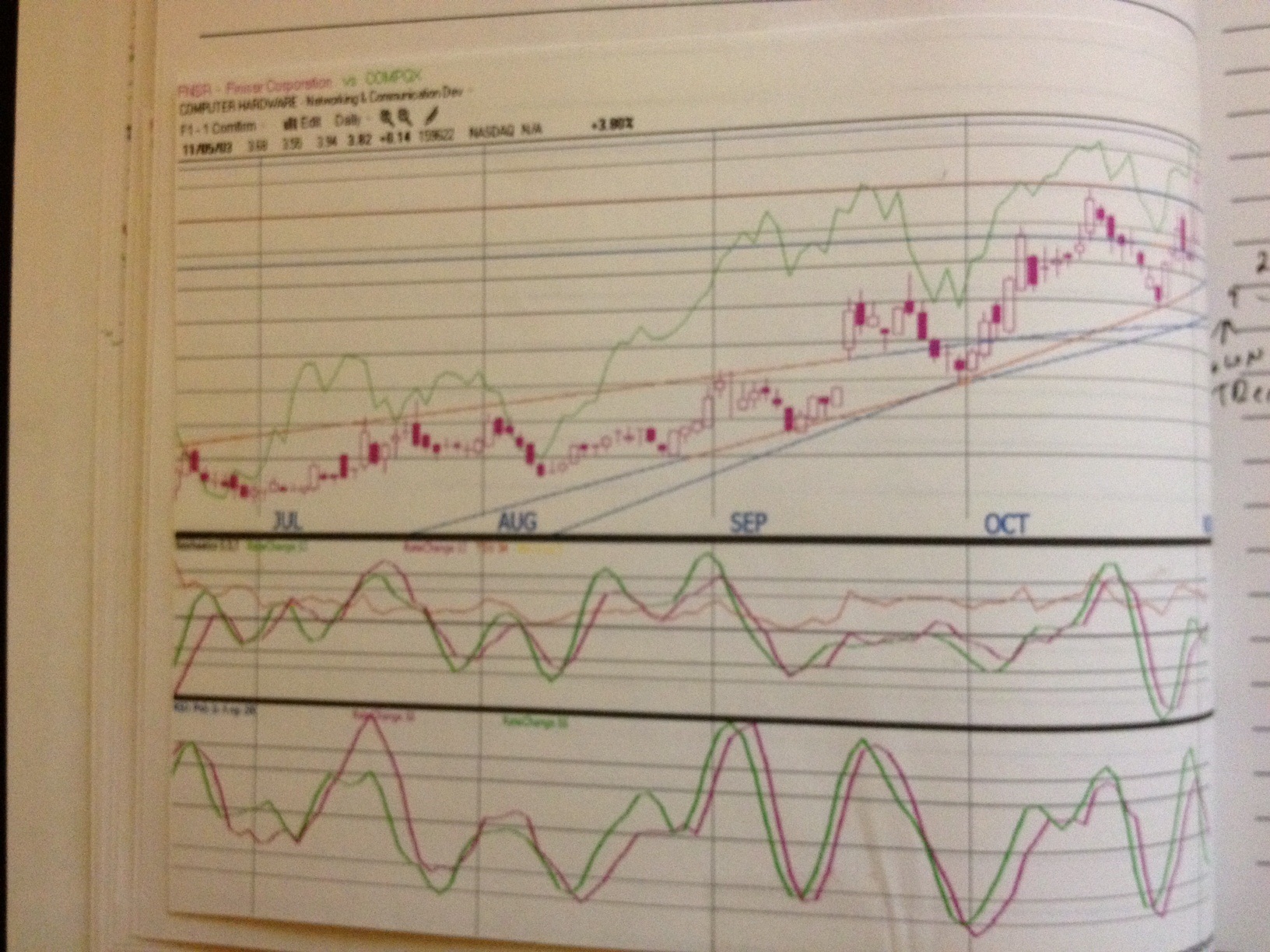

Here is one from my journal from 2003: FNSR ( see attached pic from my journal)

If it was not for the 1 for 8 reverse stock split it would still be under 5 bucks.

At the time it was a good looking chart.

There was another one, HLTH if I remember the ticker correctly. Healthgrades.com was the company name I think. Anyways it was suppose to be the next big .com. I bought it at 3 and then sold at a 1.25 a year later. Ouch!! soon after it went below 1.00 and was delisted.

2 very good reasons to stay away!

SD

nosce te ipsum

You make your own opportunities in life. |

|