|

Beijing,China

Posts: 22 since Sep 2021

Thanks Given: 4

Thanks Received: 9

|

TIP:My native language is not English. The following content is translated by Google. If the translation is not clear, I will explain further. thanks

I started trading in 2017. At that time, my first market was the cryptocurrency market. Within a month, I gained more than 12 times of income. In 2018, I liquidated my position and lost about 70% of my funds.

Then I got involved in foreign exchange trading. Basically, I made a small profit. In 2021, I finally chose the futures market. Obviously, I changed the market continuously because the profit was unsustainable.

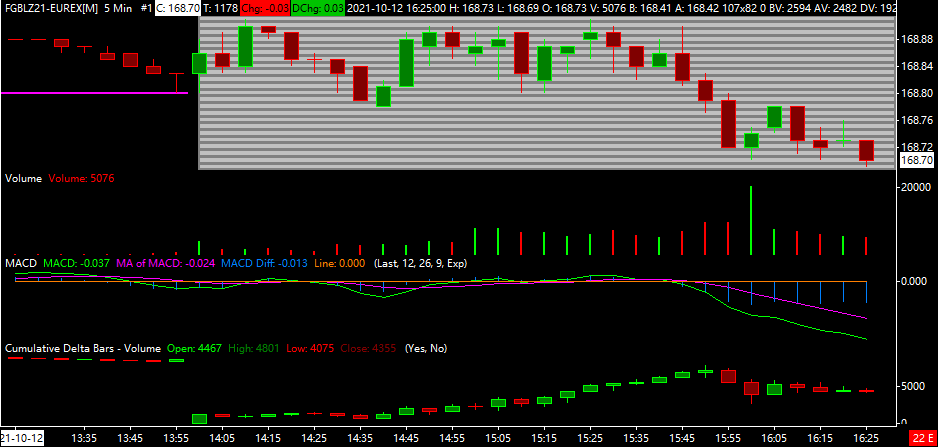

I chose German 10-year government bond futures as my first futures trading product from the performance in August and September.

I found that I encountered the same problem again. I have read other articles where losses are divided into "nuclear explosion" and "a thousand cuts", because through my trading experience in the past few years, I can avoid "nuclear explosion" , I carefully control my risk exposure, but at the same time it increases my risk of being "a thousand cuts". I have counted my losses and almost 99% are caused by "a thousand cuts"

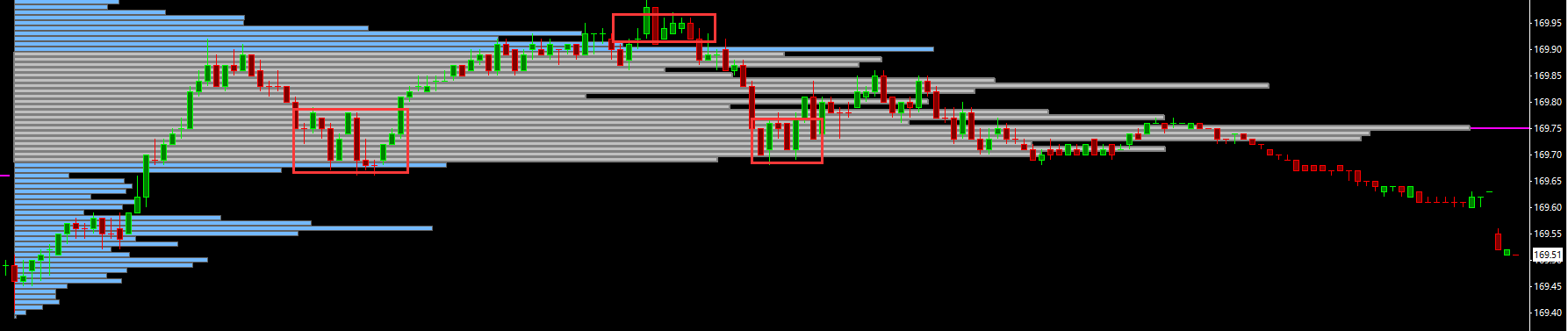

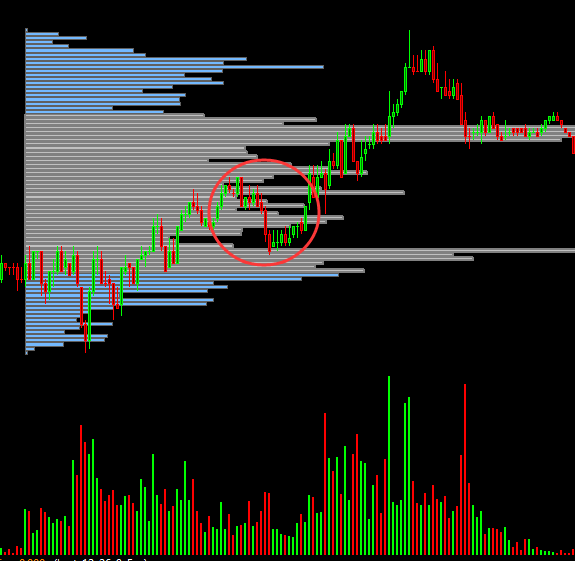

When the market fluctuates like this, its range is about 10-13 ticks, and usually the range of a period of FGBL is about 30 ticks. I will fall into this kind of continuous stop-loss trading. The most one day I lost 60 ticks on one contract, but the market after the price breakout often cannot cover my loss.

I think this is a very serious problem. After I have communicated with people I know, almost everyone has this problem. This phenomenon is particularly prominent in financial futures.

Even after breaking through this shock, the price has a large retracement (FGBL 10-15tick or more), I will close the position as soon as possible and then miss a bigger market.

Regarding the handling of shocks and retracements, I cannot continue to profit and maintain consistency. I want to find out if there is a way to deal with this pattern. I am not looking for the holy grail of trading, which does not exist. I think that the profit of trading lies in accumulation. In the trend, I think that everyone’s ability to make money is almost the same. How to reduce losses is the key to profit.

|