|

New York

Experience: Beginner

Platform: NinjaTrader

Broker: NinjaTrader

Trading: Futures

Frequency: Every few days

Duration: Years

Posts: 67 since Mar 2023

Thanks Given: 68

Thanks Received: 37

|

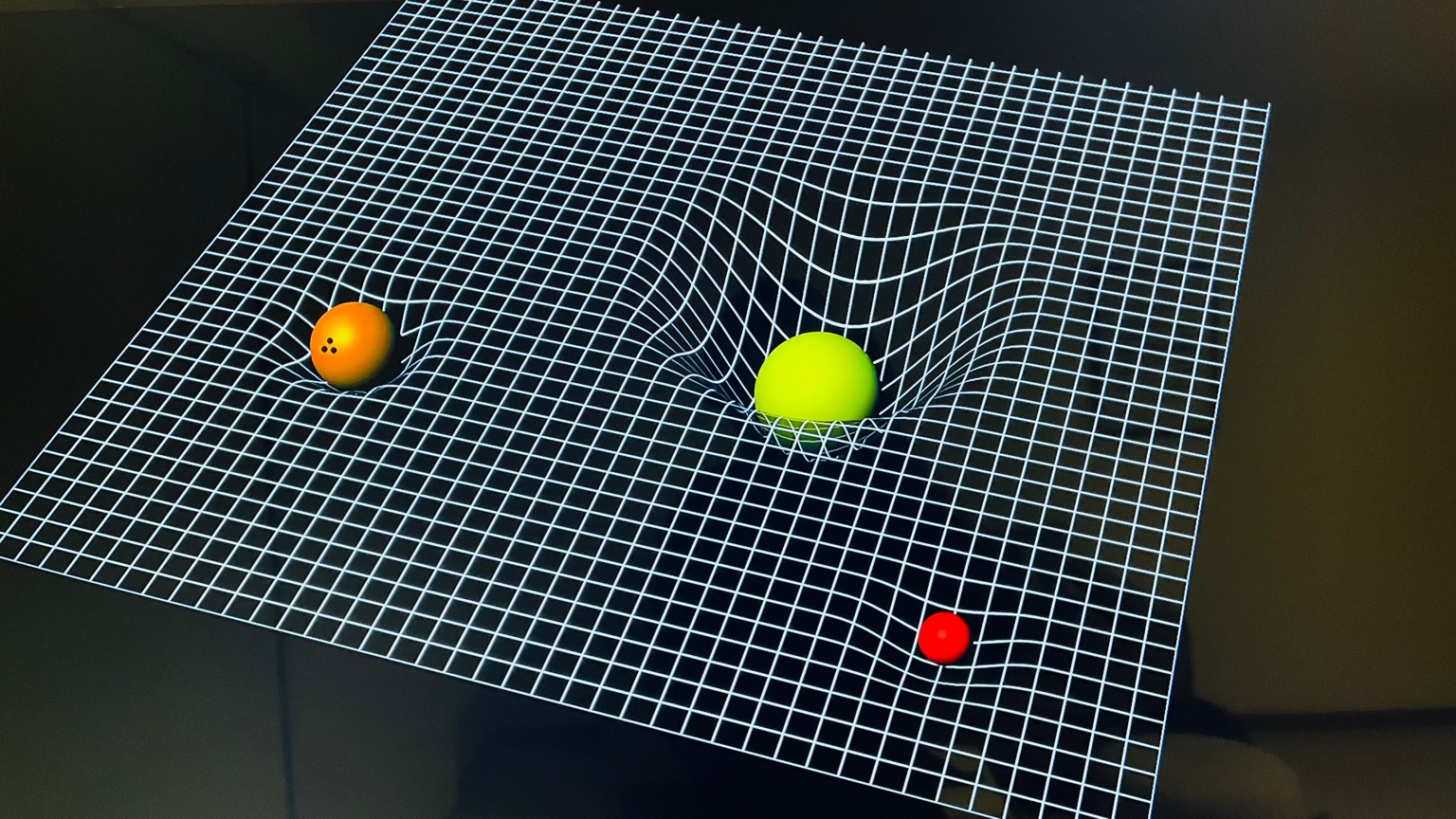

As a metaphor for the dynamics of a financial market, a view of the space time continuum can be helpful.

• Large Sphere (Major Players/Events): The large yellow sphere with the deepest indentation could represent the impact of major institutional investors or significant economic events. Their actions or occurrences create ‘waves’ in the market, which can be thought of as periods of high volatility or large price movements. For traders, these waves can present both risks and opportunities.

• Medium Sphere (Medium-sized Players/Events): The orange sphere creates a medium-sized indentation, perhaps symbolizing medium-sized firms, investor groups, or economic indicators that have a noticeable but not overwhelming influence on the market. Their impact might create ripples that can affect certain sectors or the market at a more moderate level.

• Small Sphere (Retail Investors/Minor Events): The small red sphere with the slightest indentation could represent individual retail traders or minor news events. While their influence is limited compared to the larger spheres, they can still contribute to market liquidity and can be part of larger collective movements when acting in concert.

• Oscillations and Market Dynamics: The ripples or oscillations around the spheres reflect the spread of the impact from the initial event or trading actions. In a real market, this could be seen as the momentum of a price movement that can affect different securities and sectors to varying degrees. For instance, a major news release might initially impact the sector it’s most related to, but as market participants react, the effects can ripple out to affect the broader market.

Understanding these dynamics helps traders and investors to anticipate potential market movements and plan their strategies accordingly. For instance, knowing that a Federal Reserve announcement is imminent, a trader might expect significant ripples in the market and position themselves accordingly. Similarly, understanding that a small news event is unlikely to cause large oscillations might lead a trader to expect stable market conditions and plan for a different trading approach.

|