I find it necessary to make sure to stay out of the markets when they are "slow" vs "fast". However, historically that is challenging as it has been quite subjective. Watching the time and sales order flow gives a sense, but what is fast now vs earlier or another time period is still subjective.

I wrote the following simple indicator which gives some level of quantitative visibility if the mkt is moving fast vs slow. The indicator takes the time difference between the the last tick update of the bar compared to the previous tick update. A slower market will have a longer duration and therefore a larger value. A fast market will have very short durations of updates with values closer to 0.

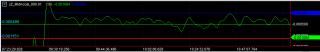

I trade with tick charts so that is the lens that I am viewing this indicator. I wanted to have the values coincide with visual trend of values that are trending "up" (faster) vs "down" indicating slower mkts. That is why I applied a sign reversal to the values in the code.

When using the indicator, values closer to 0 indicates very fast, vs. values with larger negative values represent a slower market (hence the duration between updates is longer in duration). In the screenshot, I have a green line and red line manually applied which are my thresholds for fast vs slow. Those levels were based on my own analysis and screen time of the market being traded. You will have to gauge levels yourself based on the market and chart used.

Suggestions welcome and glad to contribute.

Code written in easy-language with use with MC 64 v12.0

Indicator version v000.01

Cheers,

JZ

Category MultiCharts

|

|

|