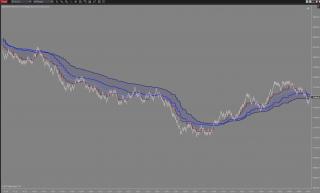

Description: This indicator will draw four moving averages/filters based on user input. It is mainly used to draw higher frame moving averages/filters on lower frame charts to give reference to market condition (trending, consolidating, etc) from the higher frame perspective. Four averages are used to give some clarity of this. The indicator allows you to choose

from several bar types and averages/filters (see below).

Installation: This file contains four bar types that require a restart of NT after being imported. Bar types are: Reversal, Delta, BetterRenko, and UniRenko. If you already have these, just skip over them during the import. Included in the zip file are many indicators. If you have made any customizations to any of these named scripts, you should consider skipping that particular indicator when it prompts you to [skip or overwrite]. If you have made changes and you overwrite, your custom code is gone. You may want to make a backup copy of your indicator directory before you import just to be on the safe side. You only have to worry about this if the name of a script in this zip file matches one you already have.

Available Bar Types (* non-standard NT bar types; requires installation and restart NT):

Month, Week, Day, Minute, Range, Second, Tick, Volume, Renko, (* Reversal, Delta, BetterRenko, UniRenko)

Updates:

1) The following are set to false. You may want to set them to true and recompile:IsAutoScale = true;

DrawHorizontalGridLine = true;

DrawVerticalGridLines = true; Available Moving Averages/Filters:

AdaptiveExponentialMA, AdaptiveLaguerreFilter, AhrensMA, AverageDirectionalVariableMA, AutoRegression, ArnaudLegouxMA, Butterworth_2Poles, Butterworth_3Poles, DonchianChannelMean, DoubleExponentialMA, DistantCoefficientFilter, DeviationScaledMA, ExponentialHullMA, ExponentialMA, ElasticVolumeWeightedMA, GaussianFilter_2Poles, GaussianFilter_3Poles, McGinleyDynamic, HeikinAshiZeroLagTripleEMA, HullMA, HoltEMA,JurikMA, KaufmanAdaptiveMA, LaguerreFilter, LinearRegression, MovingMeanTPO, MovingMeanVWTPO, MovingMedian, MovingMedianTPO, MovingMedianVWTPO, Percentile_50, RangeWeightedMA, ReverseEngineeredRSI_50, SimpleMA, SineWeightedMA, SuperSmoother_2Poles, SuperSmoother_3Poles, Tillson3MA, TimeSeriesForecast, TripleExponentialMA, TripleWeightedMA, TriangularMA, VariableIndexDynamicAverage, VariableIndexDynamicAverageCMO, VolumeWeightedEMA, VolumeWeightedMA, WeightedMA, ZeroLagExponentialMA, ZeroLagTripleExponentialMA

Primary Input Parameters:

1) Bar Type (see gbMAxMTFx4_BarTypeEnum enum for list of available bar types)

2) Bar Value

3) Moving Average Type (see gbMAxMTFx4_MATypeEnum enum for list of available averages and filters)

4) Four Moving Average Lengths (Period 1, 2, 3, 4)

Non-Standard NinjaTrader Bar Types Used (you'll need to install these if you don't already have them):

1) Reversal Bars

2) Delta Bars

3) BetterRenko Bars

4) UniRenko Bars

UniRenko Parameters: If using a UniRenko Bar, you'll need to specify the Bar Values in the "Parameters - UniRenko" area.

1) Tick Trend

2) Tick Reversal

3) Open Offset

Limitations:

1) This indicator is not intended to have a frame less that the host chart. This should not present any runtime issues, but be mindful that plots are displayed based on the frame used by the host chart. Thus, if price goes up 10 points and then down 10 points before the host chart bar closes, you're not going to see this. The proper

way to use this indicator is with a higher frame than the host chart (i.e., 10 min indicator on 1 min chart, etc).

2) Most averages require a minimum of 1 period, except for: DeviationScaledMA (2), Holt EMA (2), Kaufman Adaptive MA (5), Linear Regression (2), Percentile (4). If you enter a value less that the minimum, the script will use the minimum but display what you used as input.

3) This script uses averages/filters that mostly use Length as there main input. Indicators such as MAMA and iTrend were not included since they don't use Lenght as an input.

4) Default values are used for parameters in some averages/filters that require more than Length as input, such as: Arnaud Legoux Moving Avg, Butterworth Filter, Deviation Scaled MA, Gaussian Filter, Jurik MA, KaufmanAdaptiveMA, Percentile, Reverse Engineered RSI, and Tillson3 MA.

5) Some averages/filters require a short and long term period as input (i.e., VariableIndexDynamicAverage). In these cases the Length is used as the short-term period and the long-term period is three times the Length.

Category NinjaTrader 8 Indicators and More

|

|

|