|

San Diego CA, USA

Experience: Beginner

Platform: TradeStation

Trading: YM

Posts: 22 since Jan 2012

Thanks Given: 12

Thanks Received: 5

|

Well it has been a while since Ive posted. I realized that just finding patterns without any understanding of why they are forming and what part of the structure they are in just doesnt make any sense. It wasnt a clear plan that I could believe in. Just like I cant believe in MA crossovers. 2 lines crossing each other doesnt make a trading plan. Well it has been a while since Ive posted. I realized that just finding patterns without any understanding of why they are forming and what part of the structure they are in just doesnt make any sense. It wasnt a clear plan that I could believe in. Just like I cant believe in MA crossovers. 2 lines crossing each other doesnt make a trading plan.

Gone are my range bar charts. Replaced with 60 min and 5 min charts with volume on one screen and daily charts on the other.

Lately I have been studying. pretty hard too.

Recently I was told that if I could learn to trade that I would be funded with a 50k account. That blew me away. It also let me know that someone believes in me. That felt good. It also scared me.

Well I reset my sim account to 55k and resolved to start trading. I still didnt know what the heck my plan was so I started watching the webinars here. Thank you Big Mike for all the educational opportunities here!

I really liked the Volume profile webinar and would love to learn it but I would have to change platforms, get a new broker and data feed so that was put on hold.

I then watched Dr. Gary Dayton's webinars on the Wyckoff method. Now I really got into that and could really relate to what Dr. Gary was saying. I've since started my journey into Wyckoff. The original materials from Wyckoff are a little hard to translate into futures trading for me. I hope to take the Chart Mastery from Dr Gary so maybe that will enlighten me a bit.

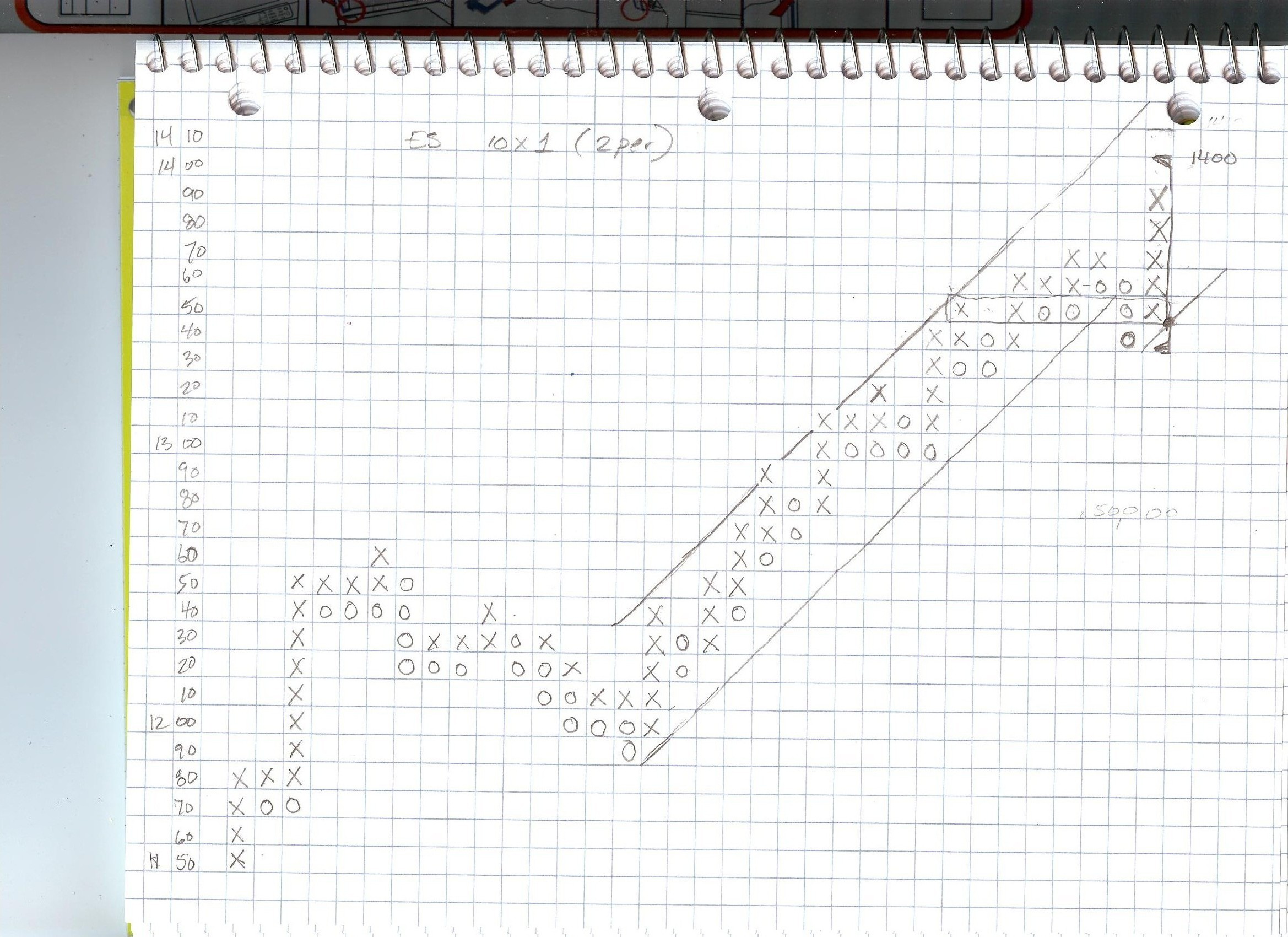

Figure charts are an important part of the Wyckoff method. I made the figure chart for the ES using a 10pnt x 1 reversal with a min of 2 boxes per column. My software doesnt do this configuration so I did it by hand. An upward breakout from the horizontal formation on the figure chart forcasted a rise to 1400. I resolved to exit at 1390.

2 very nice springs today highlighted on the 60 min chart. My trades are on the 5 min chart. I entered with 5 contracts and added 5 more before the second spring. I was trying to wait for the second spring but jumped the gun just a little.

|